- 781-659-2262

Claims made policies have distinct limitations on occurrences that happened before the policy's inception (starting date), and after policy coverage ends. Prior acts are events that happened before a policy was in place, and "Tail" is the term for after the policy ends. This blog will discuss how each of these work.

Prior Acts

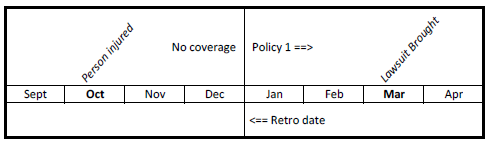

Prior acts occurred before a policy went into effect. If a claims-made policy is issued on January 1 of this year, the policy will not provide coverage for anything that happened in December of last year or earlier. The timeline below shows graphically how this works. An exception is when there had been prior insurance coverage and an earlier date (retro date) acknowledged specifically in the policy.

Retro Date

The retro date is the first day an "occurrence" will be covered if a claim is brought later. The earliest is usually the first day of the first policy. This inception date will become the retro-date for the policy, and usually remains on future policies. Thus, if your first policy was written on January 1, 2015, that date will appear on future policies as the acknowledged "retro date."

Occasionally "Full Prior Acts" option is offered, meaning there is no limitation of protection for some event (tort) that happened previously. Carriers will do this when policies have been in effect for a period that generally exceeds normal discovery periods. For example, our office has had Errors and Omission insurance for over 40 years. We now have "full prior acts" E&O protection.

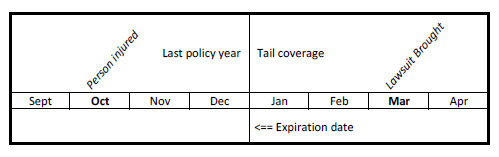

Tail coverage

Tail coverage refers to insurance that is purchased after a business stops buying current coverage, but wants protection for those 'incurred but not reported' (IBNR) claims: the ones that are out there that we just don't know about yet.

In the table below, the professional decides to sell her business on December 31st, but it's an "asset sale" meaning the buyer is buying only the assets, not the company through a stock purchase or, in other words, the liabilities. Before the sale goes through, in October in this example, a "wrongful act" has been committed (or alleged); but it's simmering. The aggrieved party is talking to his lawyer about suing the professional and they're quietly working through their legal strategy. After the professional retires, there is no further professional work, so no need to continue insurance, right? Not so fast. She needs tail coverage for the lawsuit that gets filed, in March in this example.

This coverage is customarily secured by professional service businesses when they close. As in the example, the professional may need protection for work that was done where a claim was brewing, but we're not aware of ...yet. Rather than continue to buy liability insurance after closing the business, the professional can buy this limited "tail" coverage.

This is usually available contractually, meaning the policy outlines specific options, and can usually be purchased for various lengths of time, most commonly one, three, five and 10 years.

Always work with a professional when considering these specialized terms. For more on the many differences between "claims made" options, view or comparison chart HERE.

Still not sure about a claims made policy? Read our blog, "Claims Made Versus Occurrence Liability Form."

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.