- 781-659-2262

Dignissimos ducimus qui blanditiis praesentium voluptatum deleniti atque corrupti quos dolores et quas molestias excepturi sint occaecati

cupiditates non provident, similique sunt in culpa qui officia deserunt mollitia that animi, id est laborum et dolorum fuga. Et harum quidem rerum facilis

est et expedita distinctio because those who do not know how to pursue pleasure rationally encounter consequences

Accusantium doloremque laudantium, totam sequi rem aperiam, eaque ipsa quae ab illo voluptatem quia voluptas sit aspernatur aut odit

aut fugit, sed quia consequuntur magni dolores eos qui ratione voluptatem sequi those who do not know nostrum

It is critical you insure your automobiles; it is also a legal necessity. Auto insurance protects you and your family in the event of an accident. Gordon Atlantic...

If you live in Maine, Massachusetts, New Hampshire, Rhode Island or Vermont, consider insuring your home with Gordon Atlantic Insurance. Our personalized...

Protect what matters most. Our personal lines team will take the time to get to know you and your family so you can secure a policy tailored to your...

We love living on the south shore as much as you do. And if your love of the ocean extends to sailing and motor boating, we can cover this...

It seems there are as many different options of Business Auto Insurance as there are business vehicles on the road, but we can break down the categories using a...

Two recent headlines caught our attention:

Transportation Network Companies (TNCs) such as Lyft and Uber, and similarly, Amazon Flex, are still growing like crazy, and insurance in Massachusetts has become more complicated for drivers. Without taking specific (but easy) steps, a major gap in coverage leaves drivers exposed.

The Massachusetts auto policy excludes coverage for "livery", which means driving for hire: A cab, a limo, even paid ride sharing to work counts as livery ...if the driver gets paid. TNCs are a new form of 'livery'.

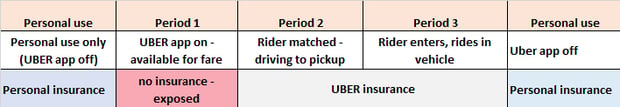

When a driver's Uber app is on and signals that the car is available for a fare or trolling for a fare, the personal insurance is suspended. And Uber's standard insurance has not yet kicked in. This is when the driver is driving without insurance.

In August 2016 Governor Baker signed a law with more stringent background checks and other regulations on Uber drivers. One feature of the law was to require TNC drivers to notify their existing insurance company of their Uber driver status. The purpose was to notify the agent or company to fill the gap through the driver's personal insurance.

Uber provides insurance as shown in the box below for when a rider has been matched, and while riding with a passenger: Once the passenger is matched with a driver, and until the passenger leaves, Uber insurance fills the gap in the personal auto policy.

What Uber insurance does NOT do is provide coverage when it is when the "I'm available" app opens. This is referred to as Period 1 in the chart below.

Today, to keep continuous coverage while you're driving your car, a Massachusetts policy needs to be endorsed. We offer a solution.

What's the solution?

We represent many companies, both Massachusetts specific and national, and we have several providers offering gap coverage solution for attractive rates. For a cost estimate for Uber or Lyft gap protection, tell us who you are (on left side, above) and we'll get you to a solution.

For more information:

Please visit our auto page: agordon.com/auto

References:

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.