- 781-659-2262

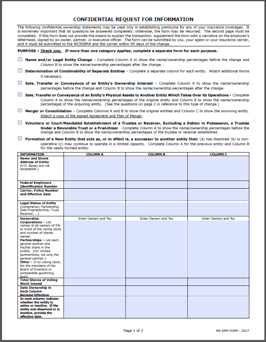

The ERM-14 form is a form required by the Massachusetts Workers Compensation Board whenever there is a change in an entity’s name, structure or ownership. The form discloses owners of an entity, such as members of an LLC, major shareholders (5% voting interest) or partners. It is used whenever there is a change in ownership, including a sale or transfer of assets.

Download our fillable version of the ERM-14

or download the form from the Commonwealth of MA here:

https://www.wcribma.org/mass/ToolsAndServices/UnderwritingToolsandForms/ApplicationsForms/MA_ERM_Form_2017.pdf

Workers compensation insurance is one of the most sensitive lines of insurance to past experience. Before this form was used, an owner of a company with a poor history of worker safety (and increasing workers compensation costs) could transfer assets of one company into another to start fresh, with no bad experience to increase those costs. Particularly in higher risk industries, the difference in companies “experience modification factor” can have a significant impact on costs. So transferring assets to another company to get a fresh start made sense, when this was legal.

The purpose of the ERM-14 form is to keep track of significant shareholders movement from entity to entity. An officer from a high workers compensation experience modification factor (the mod) now may bring that high mod to his or her new company.

How hard is it to fill out the form?

That depends on the simplicity or complexity of ownership., but we won’t sugar-coat it. It’s intrusive and looks for lots of entity structure details that may be tedious to find. One thing we do know: if an officer / shareholder of a company with bad workers comp experience becomes an officer / shareholder of another company, the experience may follow from one entity to another.

Aside from entity gymnastics, how else can a company reduce workers compensation costs?

Workers comp is the most experience-sensitive line of insurance. At Gordon Atlantic we can project the impact of claims, or no claims, on future workers comp costs, providing a compelling economic message for instilling a culture of safety. We work closely with companies on industry specific risk reduction and safety programs. A safe workplace is a competitive workplace, because lower workers comp costs mean lower labor costs relative you your peers, which translate to pricing advantages.

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.