- 781-659-2262

The Massachusetts Commissioner of Insurance recently approved an average 12.9% decrease in Workers Compensation rates. This brings workers comp costs to among the lowest in the country, making the state more attractive for new and existing business ventures.

There is value in understanding why this happens in Massachusetts. In 1991, new governor Bill Weld learned that Massachusetts workers comp rates had increased 92% over the previous four years, with the insurance industry looking for another 45% increase his first year in office. Costs were out of control, and employers were looking to other states to escape the spiraling labor expense surcharge. With a strong employer mandate and a friendly legislature, the Workers Compensation Reform Act of 1991 was passed. Since then, workers comp costs have decreased by over 60%, making Massachusetts one of the lowest cost states in the country.

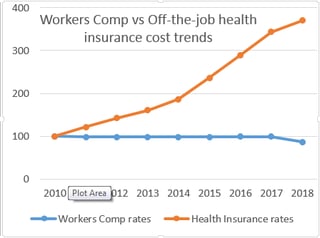

When you compare the rise in health insurance for "off-the-job" costs, that is, medical insurance costs inflation, this decrease is especially remarkable.

How has Massachusetts been so successful?

The Reform Act of 1991 attacked the fraud that had crept into the system on multiple levels: employees getting paid without working; getting hurt intentionally to receive medical benefits without deductibles; employers under reporting or mis-classifying payroll; and medical providers colluding with attorneys to build false claims for criminal plaintiffs. It had been a mess, so the new law established severe penalties for fraud at any level. Accountability is indeed an important social contract.

In addition, the law created a utilization review program to ensure medical treatment was appropriate. This mandated more transparency and accountability in the major underlying costs: health care.

What other trends caused the decrease this year?

While most small businesses are not "experience rated" for health insurance, workers compensation is experience rated for any business with over $5,000 in premium. (Read our blog on how the "experience modification factor" is developed). Experience matters! Employers have a long term vested interest in keeping safe workplaces, including specific programs for getting workers back to work after they're hurt, even if just on light duty assignments. A business with high loss experience simply cannot close its doors and open a new business to re-set the experience factor; ownership information is required for newly formed businesses to ensure high losses follow the owner, not just the company. This is a system with long term accountability.

This sounds like great news. Is there any downside?

This is great news for every company paying workers comp premiums, but the market for insurance will change: every insurance carrier will review whether an account is profitable with nearly 13% less income. Today Massachusetts enjoys a robust workers comp market, meaning most employers can get the insurance voluntarily, not through the "assigned risk" program. With rates 12.9% lower, insurance companies will be more cautious in who they'll insure. Unlike all other insurance, rates are set by the state, so companies generally don't compete on price. There are small variations on this -- some discounts are available for certain employers -- but base rates are still the same, based on classification.

The problem arises if loss experience or other factors mean no carriers will accept a business voluntarily. The rates in the assigned risk pool are the same, but case management (for claims) is paid to pool carriers for a fee. Losses are aggregated and shared across the pool so an insurance company doesn't have its own skin in the game. When a carrier can spend a dollar on case management or loss control engineering to save two dollars on projected losses, it makes sense. If those expenses will save only ten cents on the dollar because every carrier pools losses, they don't make economic sense.

As with other kinds of insurance, resources dedicated to preventing and mitigating losses in front of an insurance program usually lowers the overall cost of risk most effectively. To keep your company more insulated from risk and keep the cost of risk low, contact a Gordon Atlantic professional today by calling toll free 800-649-3252. Prefer to type versus talk? Click below.

Should you need some assistance in preparing for a Workers Compensation audit, click HERE for an informative video and/or a written preparation guide.

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.