- 781-659-2262

Independent contractors, or subcontractors, are treated differently by insurance companies, the IRS and by the Massachusetts Department of Revenue. The purpose of this blog is to highlight the differences and to outline why the Massachusetts definitions are so important to so many businesses.

Independent contractors (ICs) perform a variety of functions, some of which aren't core to the work of the hiring company. The determination on whether a worker should be classified as independent versus an employee comes down to several factors.

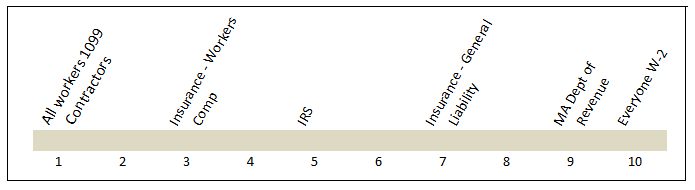

Every business wants to know how subcontractors and insurance interact, but how governmental agencies (in this case the MA Department of Revenue) view these relationships is important, too. The spectrum below gives a sense of where different perspectives lie. On the left end, a company has an owner and no "employees;" all work is done by independent contractors. To the right, all workers performing work are employees. Massachusetts DoR has the broadest definition to capture workers as employees while the IRS is somewhat further down the spectrum. Insurance rules and regulations fall somewhere between these two depending upon the industry, the kind of insurance, and the way insurance costs - particularly general liability and workers compensation - are quantified.

In the past it was simple: if someone was an employee they received a W-2 while ICs used the reporting form 1099. Employers were responsible for collecting payroll taxes and income taxes from W-2 employees, but ICs were on their own to report their income and pay taxes. Collection of taxes by an employer was more predictable, effective and enforceable, so tax collectors preferred workers to be classified as W-2 employees. As more employers began using ICs to manage labor costs and reduce insurance costs, the incidence of insurance fraud, below market wages, unfair competition and tax compliance grew...so state officials tried to change that.

In 2004 Massachusetts passed a law intended to classify more independent subcontractors as employees. This law established a three part definition: "...an individual performing any service shall be an employee unless:

Failure to comply can result in taxes, simple fines and criminal offenses. Principals of corporations or members of LLCs (the people who are the employers) can be held personally liable for violations.

Guidance directly from the Commonwealth of Massachusetts is provided here: http://www.mass.gov/ago/docs/workplace/independent-contractor-advisory.pdf

Because of the large fines and potential for triple damages and huge legal fees, this wage act has been characterized by some as the new ‘tobacco’ for prosecuting attorneys. Businesses beware!

Insurance companies want to collect premiums wherever a risk of loss exists. The basis for developing an insurance cost can be broken down by payroll to employees and expenses paid to subs. If the subcontractors have their own insurance (see certificates) the charge is a fraction of the charge for direct labor. But when subcontractors do not have their own insurance the employer pays the same wage as they would for their own direct labor. This is why collecting insurance certificates, and being named as additional insureds, can be such an important cost consideration for businesses that use independent contractors.

Real Estate agents as independent contractors have long been an exception to the broad categorization of contractors as direct (W-2) workers. A specific law (G.L. c. 112.§87 RR) protects this carve-out classification, but that law was recently challenged by a group of real estate agents who argued they should be classified as employees. A Superior Court judge ruled last year that the real estate law still holds, but attorneys we’ve consulted believe this decision will be challenged in the Appeals Court and will probably end up in the Supreme Judicial Court.

As experts in risk we recommend obtaining certificates of insurance from people you do business with to reduce your risk and to keep your own risk and insurance costs low. The wage law can be a separate threat for which no insurance is available. Consult with other professionals including legal and accounting counsel for more detail on how the 2004 Massachusetts wage law affects your business specifically.

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.