- 781-659-2262

Most consumers are familiar with the fact that a less than perfect payment history will affect the interest rate on a loan, whether it be a car loan or home mortgage. What fewer people understand is that credit history is also a strong predictor for automobile insurance losses. Credit is second only to driving history for insurance company actuaries, the number-crunchers who try to predict the most accurate rate for every driver.

Auto insurance costs are affected by credit in most states, but not Massachusetts, where the use of credit score in rating models is prohibited. However, companies understand the relationship, and use proxies: that is, other indicators of credit, independent of actual scores, that are permitted here. Insurance bill payment history for example.

At Gordon Atlantic we encourage people to pay up front, in full, if you can afford to. Most carriers offer a paid-in-full discount, since it's one good measure of solid finances. If taking the paid-in-full discount squeezes your cash flow, the next best alternative is electric billing, or Electronic Funds Transfer (EFT), where the monthly payment is withdrawn automatically from your bank account. This approach also eliminates installment charges or finance charges on the remaining balance, and more importantly, reduces the chance of a late or missed payment.

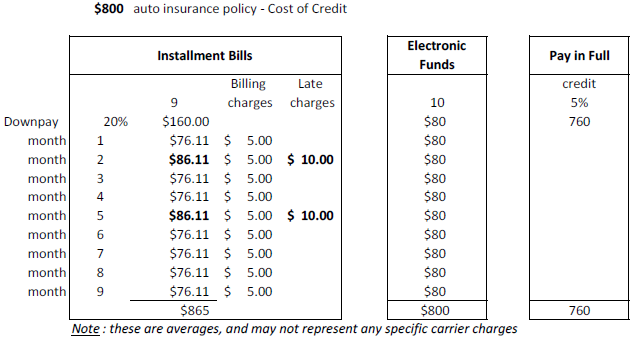

Compare the total cost of these three options in the table below. We included two late payments to show the additional impact of these costs (on renewal...wait for it).

The paid-in-full person paid 12% less than the person getting bills in the mail and missing two due dates. But wait. It gets worse on the renewal.

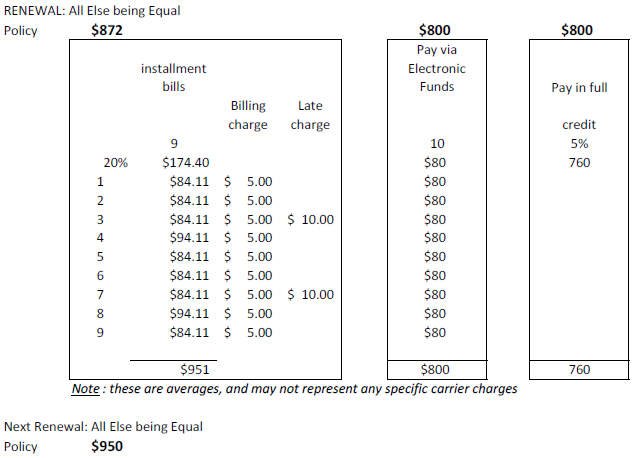

Recently I was speaking with underwriters and actuaries at one of our companies about rating algorithms. One fellow remarked casually that a single late payment will increase the next renewal by about 4%, all other factors being equal. A second late payment will bump the renewal by 9 to 10% and a third late payment by 15% or higher. Payment history is typically reviewed for up to three years.

This next table shows the effect of the same policy, 'all else being equal,' on renewal, the following year. With a couple late payments: see how the gap widens from the cost with EFT or paid-in-full. At the end of year two the the person with two late payments per year is paying 25% more than the pay-in-full option. It gets worse if the trend continues another year.

If you still get a bill in the mail, and you think you have not left enough time to mail in a payment by the due date, pay by phone is an option with most companies. Contact the company's billing department directly and arrange a pay by phone ahead of the due date. (Billing contact for carriers we represent are here: http://www.agordon.com/billpay

CONCLUSION:

Take control of your auto insurance costs by paying in full when you can, and paying electronically otherwise. Your billing history matters. A lot. (By the way, it affects your homeowners costs even more directly).

For more help with finding the best solutions for your personal needs, contact us any time.

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.