- 781-659-2262

Earned Premium

Earned premium on an insurance policy is the premium for coverage provided, and this may be for less than the full term (usually a year) when a policy is canceled mid-term, or other than on the expiration date or renewal date. The remaining amount, the amount that accounts for the period after the policy cancellation, is the unearned premium.

Here's a simple example. Let's assume a policy runs for exactly half a year. Under normal circumstances, the earned premium would be 50% of the annual and the unearned premium would be the other 50%. In this example; you get half a year coverage for half of your premium.

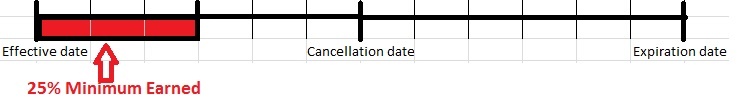

All this makes sense. But welcome to the world of insurance where administrative and underwriting costs may be accounted for as well. The distinction is important whenever we see the term "minimum earned premium". Policies for professional liability and many unusual coverages include a 25% or higher minimum earned premium.

Here's how it works: let's assume it's a $10,000 policy to insure a building has a 25% minimum earned premium (MEP). One month into the policy, the owner decides to cancel the policy, thinking he's only used up $813.33 of the insurance, expecting roughly $9,166 - a pro-rated portion - returned. Not so fast. Because the policy has 25% minimum earned, 25% or $2,500 in this example was 'earned' the day the policy was issued so the owner gets $7,500 back as "unearned" premium.

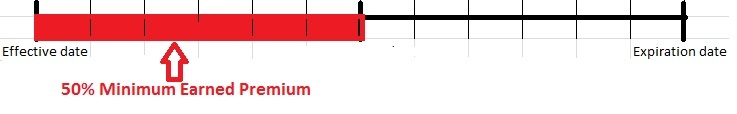

Using the same time metric as above, 50% earned is shown below. No problem if you keep the policy for more than half the expected term, but expensive to cancel earlier.

Some policies that insure more difficult properties or operations stipulate 100% earned premium. 100% earned means you pay for the whole policy up front; even if you cancel the next day; there is no unearned premium to return. These are common with vacant properties such as homes or offices which have nobody living or working there. These properties are generally for sale or in such condition that insurance carriers will dictate terms that nobody in more competitive circumstances would agree to. These kinds of situations generally take a disproportionate amount of underwriting attention up front so the underwriter offering terms is making sure they get paid.

Short rate vs Pro rated

Short rate vs Pro rated

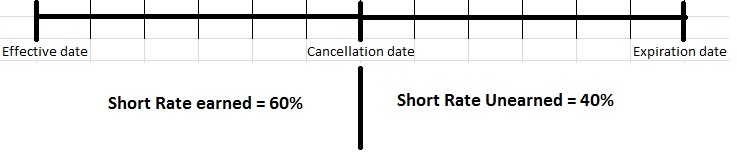

Many policies have insurance cancellation provisions that bypass the minimum earned provisions while still recognizing the underlying initial costs of underwriting and producing a policy. This method is known as short rate and is most effectively described with an example. Let's use the same example as above with the $10,000 policy to insure the building; we'll cancel the policy halfway through the year. We'll expect $5,000 back as our unearned, right? Not quite. The short rate provisions provide a sliding scale throughout the policy term whereby 60% is earned, meaning only 40% is unearned and returned. This has the same effect as a 10% cancellation penalty, so it's worth paying attention to when the need for protection remains, but you decide to change carriers.

Billing

Bear in mind that billing arrangements are independent of these policy provisions. While monthly billing programs generally track pretty close to the earned / unearned cross-over, because of statutory cancellation notice requirements and other delays, it is possible to have a policy cancel for non-payment, and still owe money after the cancellation. As bizarre as this sounds, it still can happen under some circumstances.

Contact us to start a conversation about your insurance!

We are local insurance experts serving the South Shore for over 70 years.

Click below to get a free quote for your personal or business insurance.